how to calculate cash assets

The companys cash flow from assets may indicate to. List all cash receipts from the sale of fixed assets.

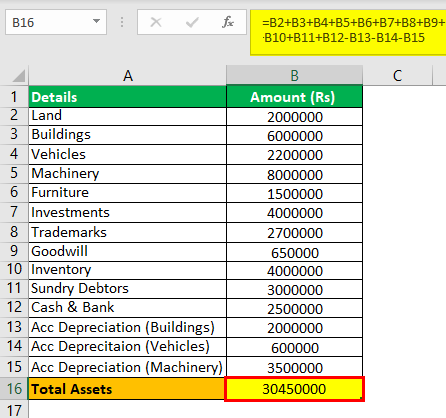

Total Assets Formula How To Calculate Total Assets With Examples

This is a positive cash flow.

. Once they have these three numbers Johnson Paper Company can calculate their cash flow from assets. The ratio of liabilities to total assets shall go up as the owners take out the cash which is part of an asset from the firm or the business. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in working capital 15000 payables - 30000 receivables - 10000 inventory -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets.

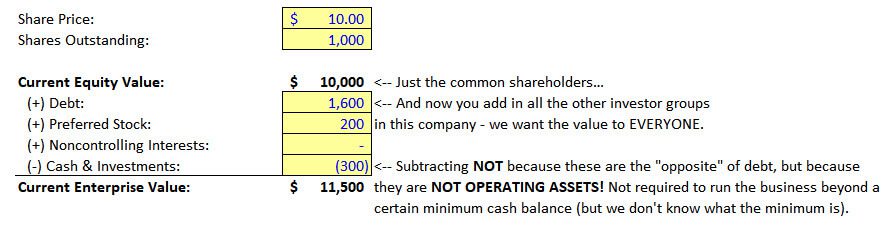

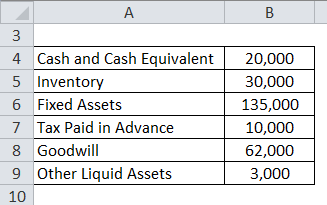

A growing cash balance suggests a company may be improving its performance and generating more sales. Current assets cash cash equivalents inventory accounts receivable marketable securities prepaid expenses other liquid assets. Calculate your current assets.

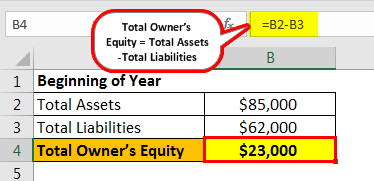

Review the general ledger and income statement. Subtract the amount of noncash current assets from total current assets to calculate the companys cash balance. Net income Total average assets Cash return on assets The answer tells financial analysts how well a company is.

Information should include a brief description of the item sold and dollar amount received from the buyer. Its common-size percent for cash equals. The cash and cash equivalents balance is calculated by summing the balances of the cash and cash equivalent sources we mentioned among others.

To illustrate lets take a look at a couple examples. This has been a guide to Net Asset Formula. Track a companys cash balance over time to identify any changes.

Cash Flow on Total Assets Ratio Formula C a s h F l o w o n T o t a l A s s e t s C a s h F l o w f r o m O p e r a t i o n s A v e r a g e T o t a l A s s e t s. Therefore the corporation has 586 percent of its assets in the form of cash reserves. Return on assets is calculated by dividing net income by average total assets.

Say your current liabilities equal 8000. For example a corporation reported cash of 27000 total assets of 461000 and total equity of 157895 on its balance sheet. Here is the formula for current assets.

This results in the following cash flow from assets calculation. Note all purchases and sales of fixed assets primarily property plant and equipment. Cash to Current Assets Ratio Cash Cash Equivalents Marketable Securities Total Current Assets The numerator of the formula represents the value of the most liquid assets of a company.

With these numbers youll come up with 44003000 for Home Depots total assets. This number can be useful for businesses to track their progress over time. Here we discuss how to calculate net assets using its formula along with practical examples and downloadable excel templates.

When you are trying to determine whether you have enough current assets your first step is to add up those assets as a basis for comparison. For example if. You can follow these steps to measure a companys non-cash working capital using its current assets.

Johnson Paper Companys cash flow from assets for the previous year is 16000. Current Assets Cash Cash Equivalents Inventory Accounts Receivables Marketable Securities Prepaid Expenses Other Liquid Assets Current Assets 6000 500 1000 2000 200 2000 Your total current assets for the period are 11700. Average Total Assets Beginning Total Assets Ending Total Assets 2.

Add the three amounts to determine the cash flow from assets. 24000 -10000 2000 16000. Cash Return on Total Assets Ratio Operating Cash Flow Average Total Assets You can calculate the average total assets by summing the beginning and ending total assets and then dividing the result by 2 as follows.

Companies have different cash requirements. In this example subtract 125000 from 200000 to get 75000 in cash. 27000461000 x 100 586.

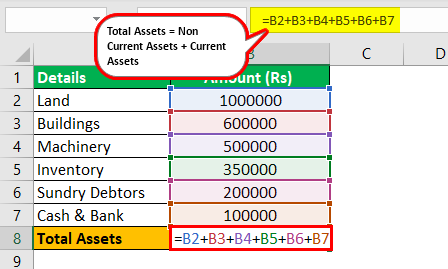

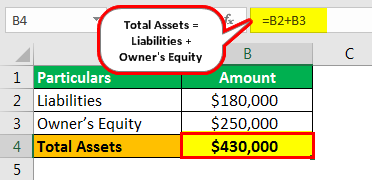

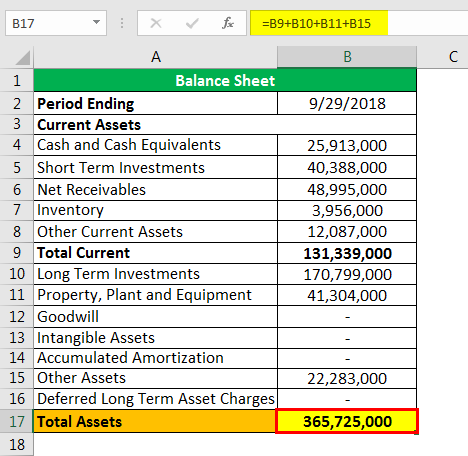

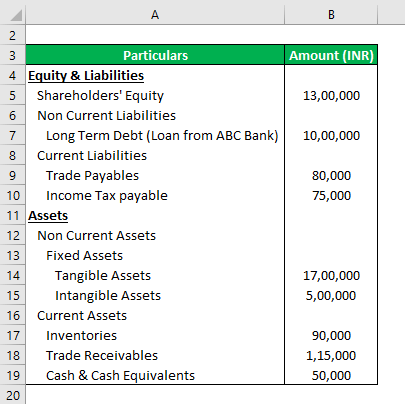

To calculate Home Depots total assets simply add their current assets 18529000 to their long-term assets 25474000. To calculate a companys current assets you can use the following formula. To calculate total assets you take the average of all the assets between two account periods.

To calculate total assets all you have to do is add the sum of current assets and long-term assets. Cash and Cash Equivalents This includes any liquifiable investments of the business. Essentially current assets are those assets that can be used to pay for your businesss operating expenditures.

Cash and cash equivalents such as money market funds commercial paper treasury bills etc are examples of current assets. Cash and cash equivalents include instruments that can be converted into cash in three months or less. Current assets cash and equivalents accounts receivable inventory short-term investments prepaid expenses other liquid assets.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-07at10.21.44AM-4b083a721f744f4ebb05c3a418c382d2.png)

Current Assets Vs Noncurrent Assets What S The Difference

Accounting Basics Purchase Of Assets Accountingcoach

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

Total Assets Definition Example Applications Of Total Assets

Total Assets Definition Example Applications Of Total Assets

How To Calculate Total Assets Definition Examples

Total Assets Formula Formula Calculation Explanation

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

Current Assets Formula Calculator Excel Template

Total Assets Definition Example Applications Of Total Assets

How To Calculate Enterprise Value 3 Excel Examples Video

Current Assets Formula Calculator Excel Template

Current Assets Formula Calculator Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Net Asset Formula Examples With Excel Template And Calculator

Total Assets Formula How To Calculate Total Assets With Examples

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)